Web Checkout

Web Checkout is a simple way to integrate a checkout feature into your existing products. It is the fastest and easiest way to get paid online, with minimal code required for integration.

Why use Web Checkout:

- Ease of integration.

- Secured checkout experience.

- Access to multiple payment options with a single integration (Eg, Card, Transfer, USSD, Wallet, GooglePay, etc.)

- Boost checkout completion using inline checkout. This means that using inline checkout makes it easier for customers to complete their purchases, leading to increased sales.

The availability of a payment option or method is dependent on the country.To view the payment options per country , please click here

How to integrate Web Checkout

Integration options

There are two ways to integrate Web Checkout into your product:

- Inline Checkout: This allows the customer to complete payment without navigating away from your site.

- Web Redirect: This navigates the user away from your site to the Interswitch payment page. Users are redirected back to your site when they complete the transaction.

Test CardsClick here to get test cards to test your transactions.

Option 1 - Inline Checkout

With Inline checkout payment, a widget will open in a popup on your current page, without the need for a redirect. This allows the customer to complete payment without navigating away from your site.

To use Inline Checkout, include the inline checkout script at the bottom of your page's body as shown below

<body>

...

<script src="https://newwebpay.qa.interswitchng.com/inline-checkout.js"></script>

<body>

Go LiveTo go live, change src value to 'https://newwebpay.interswitchng.com/inline-checkout.js'

To initiate checkout, call window.webpayCheckout(request). The request object contains your payment parameters.

A callback function will also be passed in to receive the response from the checkout. Also please pass in the required country code to accept payments in your selected currency. View country codes here

Example of inline checkout implementation

//declare callback function

function paymentCallback(response) {

console.log(response);

}

//sample payment request

var samplePaymentRequest = {

merchant_code: "MX007",

pay_item_id: "101007",

txn_ref: "sample_txn_ref_123",

site_redirect_url: "https://google.com/",

amount: 10000,

currency: 566, // ISO 4217 numeric code of the currency used

onComplete: paymentCallback,

mode: 'TEST'

};

//call webpayCheckout to initiate the payment

window.webpayCheckout(samplePaymentRequest);//declare callback function

function paymentCallback(response) {

console.log(response);

}

//sample payment request

var samplePaymentRequest = {

merchant_code: "MX007",

pay_item_id: "101007",

txn_ref: "sample_txn_ref_123",

site_redirect_url: "https://google.com/",

amount: 10000,

currency: 800, // ISO 4217 numeric code of the currency used

onComplete: paymentCallback,

mode: 'TEST'

};

//call webpayCheckout to initiate the payment

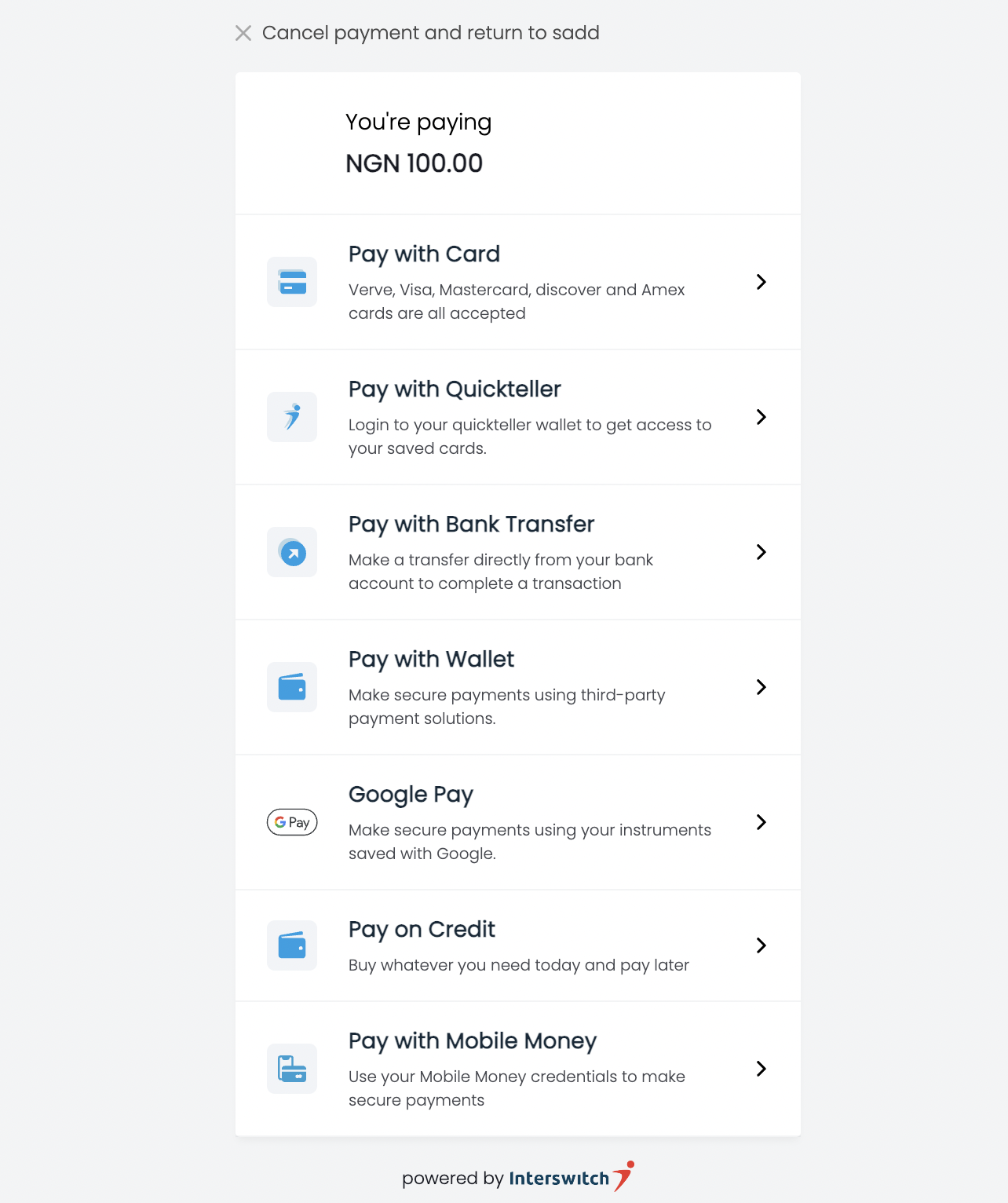

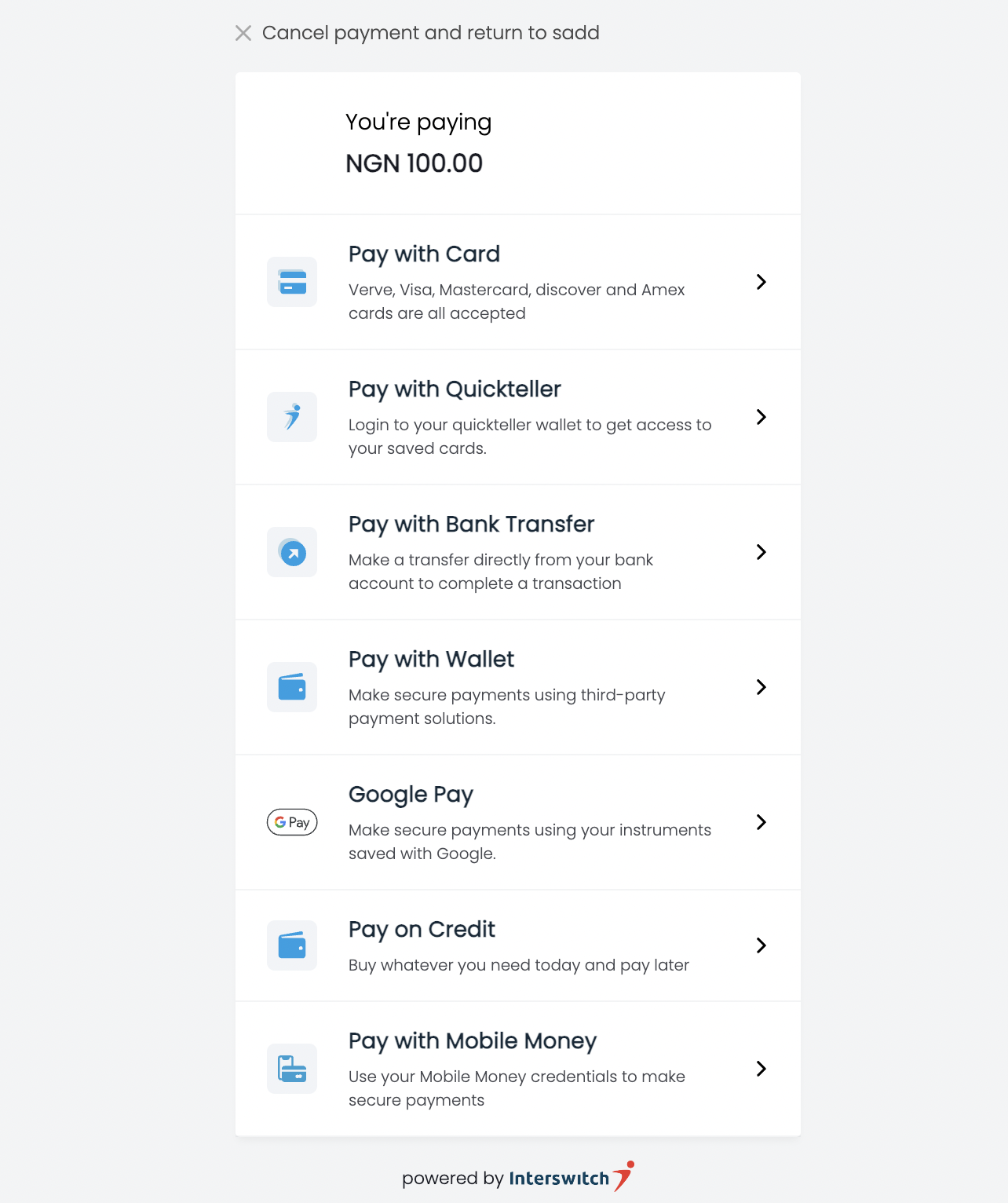

window.webpayCheckout(samplePaymentRequest);After implementing the code above, a modal will appear, showing the available payment methods for that country, such as NGN for Nigeria or UGX for Uganda.

That's it! If you want to see more sample code, check out this repository.

Below is a full list of inline checkout parameters

| Field Name | Data Type | Required | Description |

|---|---|---|---|

| pay_item_id | String | true | payable_code |

| pay_item_name | String | true | Name of the item being paid for |

| txn_ref | String | true | transaction reference |

| amount | String | true | Cost of the item you want your customer to pay |

| currency | String | true | ISO currency code . View Country codes here |

| cust_name | String | false | merchant customer name |

| cust_email | String | True | merchant customer email |

| cust_id | String | false | merchant customer id |

| cust_mobile_no | string | false | merchant mobile number |

| merchant_code | String | false | The Merchant's code |

| site_redirect_url | String | false | Merchant's website redirect url |

| tokenise_card | String("true" or "false") | false | Flag to indicate whether you want the customer's card to be tokenised, a tokenised value would be returned when you requery to confrim the transaction status |

| access_token | String("true" or "false") | false | Access token value gotten from passport |

| mode | String("TEST" or "LIVE") | true | The mode of the payment |

| onComplete | Object (function) | true | The callback function that returns the state of a transaction. |

Option 2 - Web Redirect

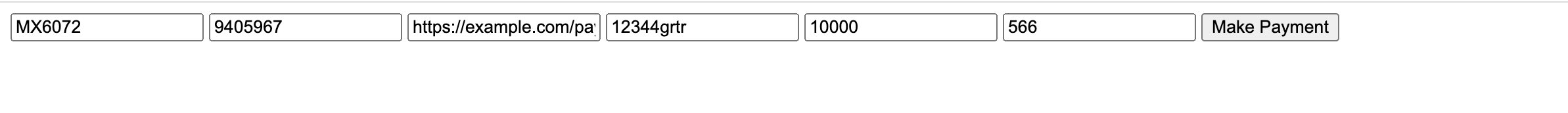

With Web Redirect, the user will be navigated away from your site to the payment page after clicking The Make Payment button.

To use web redirect, include the following form on your checkout page:

<form

method="post"

action="https://newwebpay.qa.interswitchng.com/collections/w/pay" >

<input name="merchant_code" value="MX6072" />

<input name="pay_item_id" value="9405967" />

<input

name="site_redirect_url"

value="https://example.com/payment-response"

/>

<input name="txn_ref" value="12344grtr" />

<input name="amount" value="10000" />

<input name="currency" value="566" />

<input type="submit" value="Make Payment" />

</form><form

method="post"

action="https://newwebpay.qa.interswitchng.com/collections/w/pay" >

<input name="merchant_code" value="MX6072" />

<input name="pay_item_id" value="9405967" />

<input

name="site_redirect_url"

value="https://example.com/payment-response"

/>

<input name="txn_ref" value="12344grtr" />

<input name="amount" value="10000" />

<input name="currency" value="800" />

<input type="submit" value="Make Payment" />

</form>

Go LiveTo go live, change post URL to 'https://newwebpay.interswitchng.com/collections/w/pay'

After submitting the form, you will be redirected to the Interswitch payment page, where you should see the available payment methods for that country, such as NGN for Nigeria or UGX for Uganda.

When the user completes the transaction, the user will be redirected to this site_redirect_url value="https://example.com/payment-response"The URL you provided on in the code below.

You can view our sample project that shows how to integrate using Web Redirect here.

Payment Request Parameters

| Field Name | Data Type | Required | Description |

|---|---|---|---|

| merchant_code | String | true | Merchant Code on Quickteller Business |

| pay_item_id | String | true | Pay item ID on Quickteller Business |

| txn_ref | String | true | Unique merchant reference for the transaction |

| amount | Integer | true | The cost of the item you want your customer to pay for in minor |

| currency | String | true | ISO currency code. View currency codes here |

| cust_name | String | false | Name of the customer paying |

| cust_email | String | True | The email address of the customer paying |

| cust_id | String | false | Unique identifier of the customer on the merchant's system |

| pay_item_name | String | false | Name of the item being paid for |

| site_redirect_url | String | true for redirect integration | Merchant URL for the customer to be redirected to after completing payment |

Confirming Transaction Status

You need to make a server-side request to get the transaction status and amount that was paid before giving value. You make the request using your merchantCode, the relevant transaction reference, and the amount. Please confirm the amount returned by our server matches your original transaction amount before giving value.

Transaction ConfirmationAfter payment completion, you MUST make a server-side request to get the transaction status and amount that was paid before giving value.

Sample Request

curl https://qa.interswitchng.com/collections/api/v1/gettransaction.json?merchantcode={merchantcode}&transactionreference={reference}&amount={amount}

LIVE BASE URL: https://webpay.interswitchng.com

-H "Content-Type: application/json" \

-X GETSample Response

{

"Amount": 66666600,

"CardNumber": "",

"MerchantReference": "933437251484",

"PaymentReference": "UBA|API|MX187|25-07-2018|249510|719456",

"RetrievalReferenceNumber": "000647661227",

"SplitAccounts": [],

"TransactionDate": "2018-07-25T06:57:24",

"ResponseCode": "00",

"ResponseDescription": "Approved by Financial Institution",

"AccountNumber": "9999999999"

}

Response CodesYou can view the list of response codes and their meaning here.

WebhooksInstead of calling our API to confirm the status of a transaction, you can enable webhooks, and configure a URL where we make a POST request to every time a transaction status changes. You can view the guide here

Updated 3 months ago