KYC Requirements

For every business need, we have various KYC requirements. This enables us to perform our business on the right side of regulation.

Activate your Business Account

Individual Business

The requirements are as follows,

If you had chosen the Individual Business account type during your registration, select personal information and provide your first name, last name, phone number and date of birth.

Also provide a BVN, which will be instantly verified, and any of the means of identification documents specified which will be verified later. The maximum amount you can be settled as an Individual business is 500k. Once you hit 500k limit, your profile is automatically going to change to pending till you upload business documents.

FOR-GOVERNMENT ORGANIZATION / ASSOCIATIONS / RELIGIOUS ORGANIZATION

KYC FOR GOVERNMENTAL ORGANIZATIONS

Registered Business:

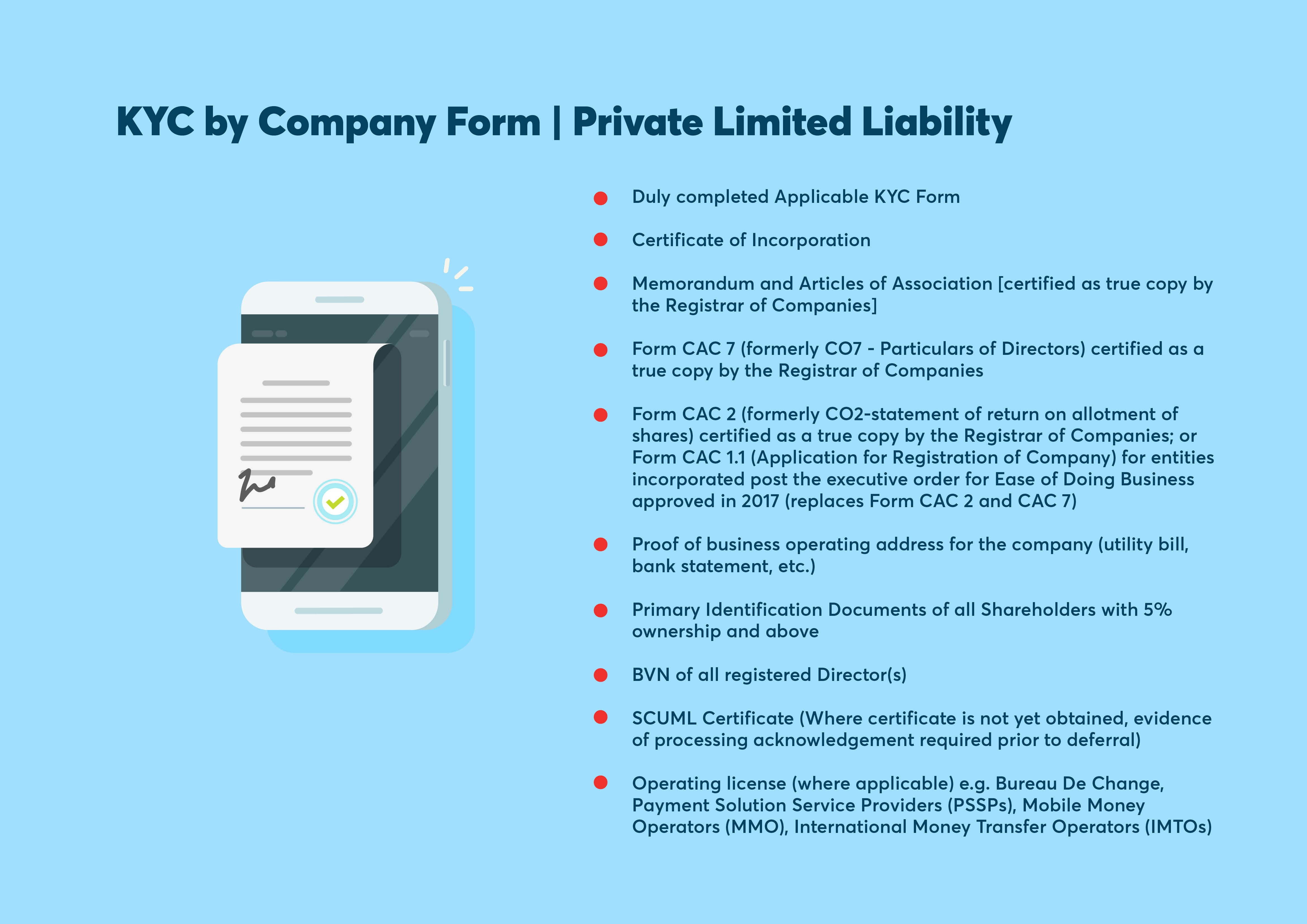

The requirements for various types of registered businesses are below:

If you had chosen the Registered Business account type during your registration, select contact information and enter your first name, last name and phone number of a primary contact person at the organization. Select Business Registration and provide your Know Your Customer (KYC) documents and information for verification.

Choose your business class, provide the Tax Identification Number of your business and upload the specified documents.

KYC BY COMPANY FORM FOR SOLE PROPRIETORS

KYC FOR DIFFERENT SERVICES

Service | KYC Requirement | Description |

|---|---|---|

Airtime Recharge | Same as general requirements | In a scenario, where a business would like to integrate to our service to resell airtime services to its customers. E.g mtn airtime purchase. |

Bills payment | Same as general requirements | In a scenario, where a business would like to integrate to our service to resell bills payment services to its customers. e.g DSTV subscription |

Transfers | General requirements/License | A license is required where our transfer service will be used on a commercial scale. This is where an entity only requires this service to disburse funds/salaries to its employees, a license would not be required. |

Bulk transfer (wallet to wallet) or Payout | General KYC and Valid License | A typical scenario is that of a betting company, where funds are transferred from a wallet to credit wallets of winners. |

Remittances | General KYC requirements/Valid CBN License | IMTO license, PSB License |

Card Payment acceptance APIs | General KYC requirements/Valid CBN License/PCIDSS certificate | Where a merchant is collecting card information directly from the customer, a PCIDSS certificate is required. |

Payment acceptance | General KYC requirements | In a scenario where a business wants to collect payment using web checkout, hosted fields, mobile SDK options, and any of our non-card |

Wallet services | General KYC requirements/Valid CBN License | Only a Deposit money bank (DMB),Mobile money operator (MMO) and Payment service bank (PSB) are allowed to hold funds. |

For a newly created account, or an account that has completed the KYC process, the Quickteller Business dashboard opens on the Get Started page, in Test mode, where the business owner is prompted to complete their onboarding in order to activate their account and move to Live mode.

The Request to go Live button triggers an approval process by Interswitch for you to begin processing transactions using the API service requested.

There are progress trackers which will inform you about the progress you've made on completing each step. Saving the information at each step allows you to explore features of the platform and return to the onboarding process when you are chanced. The steps involved in the onboarding process has been explained below. You will notice that these steps differ based on the account type chosen earlier.

Updated 3 months ago