Interswitch Business

We recognize that as a Business in the digital age, you require tools to help you thrive and compete globally. We deliver digital products and services leveraging our suite of APIs combined with business tools that help manage and simplify processes across Africa.

INTRODUCTION

Quickteller Business is a solution that empowers you to monitor your transactions from anywhere in the world.

We offer you a comprehensive, diverse set of payment tools and integrations so you can focus on delivering amazing services to your customers the way you prefer.

With Quickteller Business, you can manage multiple business accounts, generate invoices on the go, split revenue into different accounts and track every kobo that’s yours seamlessly.

After reading this guide, it will get you familiarized with fundamental components Quickteller Business offers and how to use them.

Features

The Quickteller Business solution currently offers the following key features to merchants:

-

Free Registration: Registering to use the Quickteller Business solution is free.

-

Profile and User Management: Users can be created with different profiles and privileges and managed per profile.

-

Multiple Account Setup and Management: Multiple accounts for different corporations can be setup and managed by a single user.

-

Test-Live Mode: The Test-Live mode feature allows users to navigate the solution in a test mode that facilitates the live mode.

-

Transaction Details: The details of all transactions performed daily, weekly, monthly as required are showcased on Quickteller Business.

-

Transaction Refunds: The progress of the transaction refunds that have been initiated.

-

Transaction Reports: The ability to view and download transaction reports as required.

-

Settlement Reports: Settlement reports for corporations as required are available for viewing and downloads.

-

Dispute Management: Access to view and act on customer transaction disputes raised.

-

Customer Trends and Insights: An insight that promotes merchant business based on transactions data.

-

Subscription Plans: This feature enables merchants to generate subscription plans for their customers to initiate recurring payments.

-

Payment Links: With Payment Links, you can generate links to send to your customers or share via social media for payment.

-

Invoices: This feature allows you to generate an invoice(s) for the services you provide as a company.

-

Revenue Split: This feature allows you to split revenue across customer defined accounts and required parties.

-

Audit: The audit of all actions performed on the platform by all users with access to an account.

-

Developer Tools: A toolbox for developers to integrate with Quickteller Business.

Creating An Account

Creating an account on Quickteller Business involves setting up and verifying user details, selecting an account type, and providing the required information and registration documents.

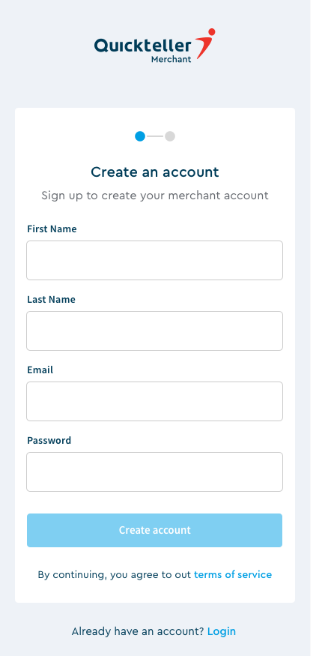

Create an Account

To create an account on Quickteller Business, follow the steps below:

- Go to Quickteller Business.

- Click on the Get Started button at the top right.

- Add your first name, last name, email address and password, adhering to our helpful password strength checker.

- Click on the Create account button.

- Check your email account and follow the prompts in the Account Verification email recieved.

Create a Business

Immediately after you've created an account, you will be prompted to create a business. To do so, follow the steps below:

-

Enter your company name and choose your business type. If you are a registered business, ensure that your business name is identical with the name in your registration documents.

-

Choose the country your business is based in and a range that accurately describes the number of employees your business has.

-

Tell us if you have software developers on your team so we can give you access to documentation and tools needed to access our APIs.

-

Click on

Proceed to my Dashboardto complete the process.

Once you proceed, your account will be in test mode and you can navigate through the platform and test the features. There are more information we require such as contact info, account details, KYC documents, etc, before you can go live and start receiving payments from anyone in the world.

Updated 4 months ago