Value Financing

This solution enables customers to purchase now and pay later using loans from the Lenders on the Interswitch Lending Platform.

Value Financing is a feature on Interswitch Lending Service that enables customers to make purchase (e.g airtime, bills, phones etc ) on credit.

Please Note:You need to have these endpoints defined on your application - Get Tenured Offers, Accept Tenured Offer, Value Financing Transaction Notification.

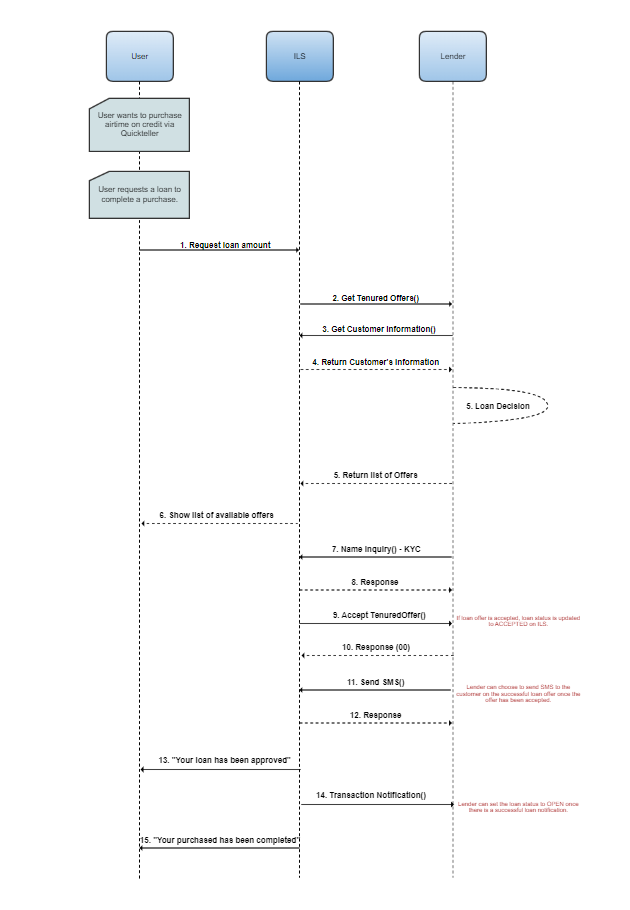

Process Flow

Step 1: Fetch the loan offer

Use the Get Tenured Offers to retrieve loan offers from a designated credit company. This enables the customer to obtain a loan offer for their purchase.

Step 2: Get the customer details

Upon receiving the offer request, use the Get Customer Information endpoint to fetch the customer's information and confirm their eligibility for a loan.

Step 3: Return on offer to the customer

After validating and confirming eligibility, provide the customer with an offer. If the customer accepts your offer, initiate an Accept Tenured Offer request.

Step 4: Verify customer account number

During the process of accepting the tenured offer, validate the customer's bank account by making a call to the verify account number endpoint

Step 5: Inform the customer of the loan approval

If the verification of the customer account number is successful, send a message using the send sms endpoint to the customer informing them of the approval.

Step 6: Get the final transaction status

Verify the final status of the loan by using the Value Financing Transaction Notification. This notification informs you(the lender) of the successful transaction, allowing you to finalize and open the loan.

Updated 3 months ago